The ultimate guide to accounts receivables and credit control is a comprehensive resource that provides an in-depth look at the management of a company's outstanding debts and the strategies involved in maintaining a healthy cash flow. This guide covers all aspects of accounts receivables, from defining key terms and concepts to discussing best practices for effective credit control. Topics covered include credit policies, invoicing, payment terms, collections, disputes and legal action.

The guide also explores the importance of credit reporting and analysis in managing accounts receivables. Whether you are a small business owner or a financial professional, this guide is an essential resource for understanding the complexities of accounts receivables and credit control.

This puts smaller businesses at risk of insolvency and hinders larger businesses in forecasting and planning for the future. A large factor in this is late and inconsistent customer payments. As most finance and accounting professionals with experience in accounts receivable will know, late payments are a problem for the majority of businesses selling on payment terms. In fact, in the average month, 48% of all invoices are paid late (Xero). More recent research shows this issue is becoming even more prevalent, with a 62.9% increase in overdue invoices since the Covid-19 pandemic (Sidetrade, 2020).

This guide will help you optimise your accounts receivable and credit control processes, and put an end to those late and inconsistent customer payments!

Your accounts receivable process shouldn’t begin once an invoice becomes overdue. World-class accounts receivable begins from the very first contact you have with a customer.

Some businesses differ slightly, but here’s an overview of the general accounts receivable process:

The first step of building an effective Accounts Receivable process is formalising a clear, internal credit control procedure. Here are the 4 most important cornerstones every credit control or ‘accounts receivable’ procedure needs.

To conduct world-class accounts receivable, you need to be empowered with knowledge about your customer. Here are the 4 questions you must ask your customer ASAP to ensure you make any future invoice chasing as effective and efficient as possible.

Very few organisations or institutions are required to report to credit agencies. Very rarely will a credit check fully and accurately represent the company in question.

Some legal matters such as CCJs may show, but even businesses with “clean” records can still be difficult customers to deal with. And for really new businesses, credit checks won’t show anything and don’t provide value at all.

Don’t fall foul of thinking a credit check is the be all and end all of assessing potential customers.

Conduct a credit check if the industry you operate in is known to have “dodgy” companies. Or if your potential customer is a total unknown whose reputation you can’t source anywhere.

You can see more guidance on when and how to conduct credit checks within your credit control process in our ‘ Essential Guide to Collections for Credit Controllers ’.

If your business insures its debt, for example, conducting a credit check on every new customer may be a mandatory requirement.

This ensures you’re getting all the data you need to perform a credit check, from the source. Make sure you include a clause to confirm your potential customer is consenting to you performing the check.

If your potential new customer is showing any red flags, ask them to pay up front for a few sales so you can judge their potential for a line of credit in future.

While you’re issuing a credit application form, ask your potential new customer to put you in contact with some past or existing suppliers. Preferably get someone in the same or similar industry to your business.

Ask the supplier:

Once you’ve opened their credit account, it’s good practice to email your new customer letting them know. This should include:

Before you agree to undertake any work with your customer, or deliver them any goods, you need to agree sales terms. These protect your business from unnecessary disputes by clearly defining the scope of the transaction between you and your customer. To enable you to conduct world-class credit control, always include these 5 things in your sales terms.

Or what the goods are, if you’re not delivering services. Your customer needs to know exactly what they’re paying you for.

Or what the goods are, if you’re not delivering services. Your customer needs to know exactly what they’re paying you for.

Perhaps an obvious one. Your customer needs to know what they’re paying you.

You should be doing this as soon as goods or services have been delivered. But you should also document this in your sales terms as evidence the customer was informed.

You should be doing this as soon as goods or services have been delivered. But you should also document this in your sales terms as evidence the customer was informed.

As a method of preparing your customer for your accounts receivable process. If you make this clear, they won’t justifiably be able to attack back when you chase them for payment. They may also be more inclined to pay you on time in the first place, because you’ll appear competent. When deciding what actions to take in the event of late payment, you can view useful suggestions in our ‘What to do when customers aren’t paying’ guide .

Whether physically or digitally, getting your sales terms signed before commencing work for your customer is key. This way they will have no justifiable grounds to challenge them, saving you a lot of potential future headaches.

An invoice is a key piece of communication between a seller and a buyer. By design it should be unambiguous. To ensure your customers are never left wondering (and potentially withholding payment because of it), never forget these pieces of information on your invoices.

Your customer needs to be able to pay you. Make it clear which methods they are able to pay you by. If you accept cheques, you should make it clear on the invoice the address and addressee of the cheque. If you need more info on different payment methods, and meeting your customer's varying payment needs, see our free guide here.

Your business bank account details. Remember, if you’re ever changing banks and need to accept payment, you need to do one of two things. Either set up a transitional arrange with your bank to ensure you can receive payment while changing. Or update your outstanding invoices and reissue them to customers to ensure they’re sending payment to the correct account.

Include these if necessary. It’s worth noting that just because you’re trading with a domestic company, you might not necessarily need to invoice a domestic company. It’s not unheard of for foreign parent companies to pay the invoices of their subsidiaries.

So your customer knows how long they have to make payment.

A critical reference point. Your payment terms run relative to this date. Together they tell your customer exactly when they have to pay their invoices by.

Check your local government guidance, if you’re a VAT-registered business in the UK, it is a legal requirement to include this.

So your customer knows what they’re paying you for. Be sure to include unit costs and quantities if applicable.

If your customer requires this. This is more typical of larger companies with multiple departments, as a way of controlling budgets. If your customer uses purchase orders, it’s extremely unlikely you will be paid if you don’t include the PO number on your invoice.

You need to issue the invoice to your customer the instant goods or services are delivered. The longer you wait, the less chance you have of getting paid on time.

After you’ve issued an invoice to your customer, you enter a new stage of the accounts receivable process. In this stage you’ll be following up with your customer via email and phone (for more guidance on accounts receivable phone calls, see our 6 best practice scripts) to chase payment. Let’s take a look at the elements that make up an email chaser.

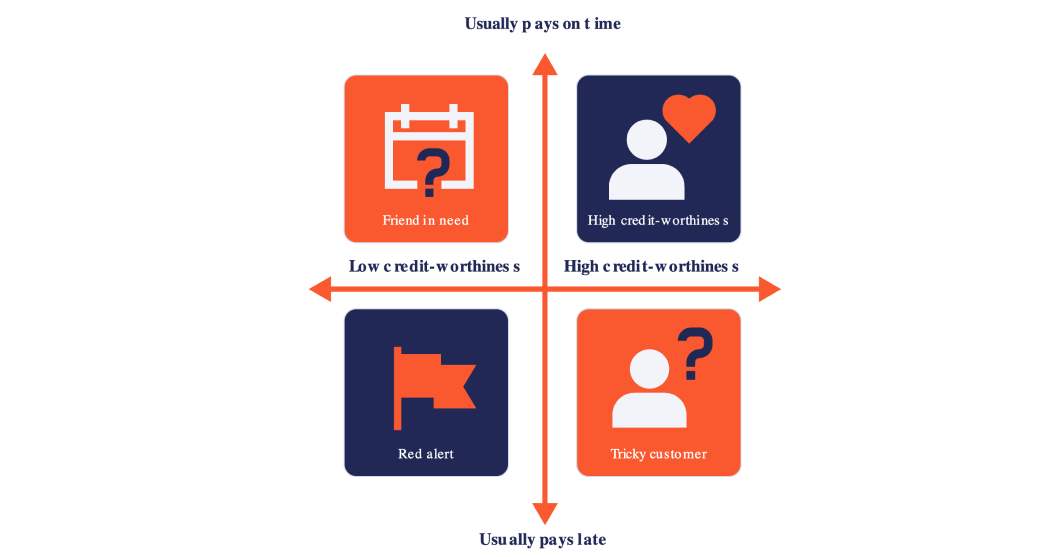

As an astute accounts receivable clerk you will have a gut feel for which of your customers’ are good payers and which are bad payers. But there is an effective rubric by which you can categorise them as such. With 2 measures - how often they pay on time, and how credit worthy* they are - you can categorise your customers into 4 types:

They usually pay on time, are responsive to chasers, and there is usually an element of inter-business friendship between yours and theirs.

What you may instinctively label “bad customers.” They’ll always pay, but usually late. They’re largely unresponsive to chasers or don’t follow through on their promises.

Usually former good customers that start to pose a solvency risk. Make up a very small percentage of most business’ customer bases. Keep an eye on their payment trends and reconsider selling to them on payment terms.

Usually former tricky customers that start to pose a solvency risk. Make up a very small percentage of most business’ customer bases. Keep an eye on their payment trends and reconsider selling to them on payment terms.

World-class accounts receivable recognises the differences between good customers and tricky customers when it comes to credit control. And tailors their approach to each of the two, to maximise results.

If you're having trouble distinguishing good and bad customers at your business, you can read our full blog on the topic What Actually Makes Customers 'Good' Or 'Bad'? here.

You’re invoicing ASAP. Now maximise your chances of getting paid on time by chasing at the best times. Chiefly, chasing frequency depends on your payment terms and when you issue the invoice.

Use your knowledge of your customers’ payment runs to your advantage. Send a chaser immediately before their next one to maximise your chance of timely payment.

For guidance on chasing best practice in times of uncertainty, for example when chasing up payments from customers whose businesses are at risk of insolvency, see our Chasing in Uncertain Times templates and our guidance on how to recession-proof your receivables .

There will always be businesses that have poor payment culture. Sod’s law says one or more of these businesses will end up a customer of yours. Escalating your invoice chasing ups the ante on these kinds of customers, making your chasing more effective. All to improve your chances of getting paid.

For many businesses, some customer relationships are better than others! You may want to chase long-term clients, or consistently good payers in a different manner to those that are consistently late-paying. For this reason, we’ve also split our escalation guidance for both your good and tricky customers.

For your tricky customers, as a last resort if all other chasing options above have failed, you have the “nuclear” options. Named such because they severely and (potentially) irreparably damage the relationship with your customer.

From least to most damaging, they are:

Below is a quick reference summary of each escalation option, to take into account before enacting any of them:

For more guidance on all things debt collection, see our ultimate guide to debt recovery.

The traditional, formal nature gives it appropriate significance.

Although a customer might miss making a payment by the invoice due date, they may have good reason and instead provide you a promised payment date. Here’s how to adjust your accounts receivable practices when that happens.

World-class accounts receivable operates on a basis of mutual respect between you and your customer. If an invoice payment date is promised, note it down, alongside:

And cease all chasing until their promised invoice payment date. If your customer misses this date, you will have even more licence to more severely chase them up. With the Chaser account receivables solution, when a customer promises a new payment date, our ‘Expected payment date’ feature automatically pauses all payment reminders until that date has passed .

It must be a specific and reasonable date, however. “During our next payment run”, “in 6 months’ time”, or similar promises should not be accepted.

At Chaser, we’ve seen that 80% of unpaid invoices can be successfully collected through email chasing alone. However, there can be up to 20% which require credit control phone calls.

Phone calls are valuable in a variety of situations. They suit some customers better than others. But here are 3 situations in which you should always make a phone call:

When dealing with very large customers, you may find making phone calls is something you do much further into the accounts receivable process compared to smaller customers. This is because it is often very difficult to get ahold of accounts staff in businesses of this size.

Ensure you have all these at hand (quite literally on your screen in front of you), before you dial:

While these 6 items are the necessary minimum, the more info you can have on hand, the better. You might get particularly feisty accounts payable staff challenging you on the wording of the sales terms, for example.

You need to achieve one of these two outcomes during your accounts receivable phone call, before you hang up:

Always note down the name of who you speak to, the date and time of the call, and the agreed next actions (i.e. passing along your message to the responsible party). If another email chaser is necessary, refer to the specifics of this phone call in it.

For more guidance on accounts receivable phone calls, see our 6 best practice call scripts .

Whenever you receive payment from your customer, late or not, always send them a thank you message. Ideally within 24 hours to not diminish its effect. This goes a long way towards building a great customer relationship over time, helping you get paid sooner in future.

Chaser accounts receivable software automatically thanks customers after every invoice payment, so you don’t have to! See how marketing agency Wolfgang Digital uses Chaser to automate their accounts receivable function, whilst keeping the personal touch with customers - and find out what they have to say about Chaser’s thanks for paying messages!

You already have a good working relationship with these customers. Show it. Remember, if you don’t keep working at cultivating this great relationship, your good customers won’t stay good forever.

Sure, they may have paid an invoice late. Again. Kill them with kindness. They’ll be less inclined to let down a nice supplier with future late payments, compared to a supplier that doesn’t show them basic human kind- ness.

If they don’t have any further aged receivables with you, politely ask them how you could work better together in future to get paid on time. You may uncover new info to help tailor your chasing to better get paid on time in future.

If they do have further aged receivables with you, you may instead use the opportunity of a thank you to help chase these up. You may uncover new info to help tailor your chasing to better get paid on time in future.

You can see our best practice guidance on thanks for paying messages, including ready-made thank you templates to send to customers after payments.

To help nudge them to switch, include on the end of your thanks for paying emails:

You can also use the opportunity provided by a thanks for paying message to secure further sales. If your customer has just had a positive buying experience from you, include a one-liner with a soft push towards further sales. Something like:

“If you’d like to reorder, please call **** **** **** or email *****@********.com.”

We’ve created our own best practice templates for thanking customers for payments , you may wish to use these as templates for your own accounts receivable emails.

Thanks for paying messages don’t just go a long way to build better customer relationships. By creating a moment in which your customer’s defences are lowered, they can be strategically leveraged for specific purposes.

Always keep consistent to your chasing schedule. If you don’t keep on top of your customer, they’ll assume you’ll go away and paying your invoices will drop in urgency for them.

Ensure you’re chasing the right person. Make a phone call and find out. If you’re correct, ask them on the phone why they haven’t been communicating with you.

Know your business. Be aware of your terms, policies, and rights. Keep all documentation up to date and accurate, and ensure all data processing and admin on your side is done correctly. No sloppiness can take place on your end. A customer that detects sloppiness or uncertainty in your approach will take advantage of it and turn it into an excuse not to pay. Be direct, unambiguous, and unwavering in your approach with your customers. Always be clear about what you will do, and follow through on what you say you will do.

It’s not just an important and powerful medium of chasing, it also helps build a better relationship with your customer. Speaking to you on the phone will make things “more real” for them than an email can. See our guidance and script templates for accounts receivables phone calls.

Whenever you have a non-written conversation with your customer, note down what was discussed, when, and the agreed next actions. Send them a summary of this in writing ASAP after the conversation. Otherwise, they may forget or even outright dispute what happened, leaving you back at square one.

Avoided by preventative measures. Ensure your customer is physically or digitally signing terms before any works are undertaken or any goods delivered.

Clean, well-managed email inboxes are rare. It’s all-too-easy for an emailed invoice to get lost (or, at least, for the customer to claim so). Avoid this excuse by attaching a copy invoice to every email payment reminder. Chaser’s credit control software lets you automatically attach a copy of invoices and customer statements to every payment reminder, so your customers can never use this excuse again!

Including incorrect customer info on your invoices can be prevented by explicitly asking your customer for their details up front. If they ever change them without informing you, they are at fault. Let them know it.

A good accounts receivables clerk avoids this by getting your customer’s explicit confirmation of the name and contact details of the person responsible for payment. If that person changes and your customer doesn’t inform you, they are at fault. But even if the “wrong” person does get your invoice, they need to take responsibility and pass it on to who makes payment. If you’ve made the best effort you could to get it to the right person, your customer cannot justifiably fault you.

Ask for an explicit date from them as to when this person will be reachable. Agree a date after that on which you’ll call back.

Your customer’s payment policy has no bearing on you unless you’ve explicitly agreed to it. Similarly, you should ensure your customer has agreed to your terms explicitly in writing - then they’re bound by them. Be aware of all relevant terms and conditions; they might not all be located on the invoice. There may be a separate contract or SLA for the goods/services provided, whose terms apply. This same advice applies for the similar excuse “Sorry, you’ve missed our pay run.”

Some customers will cite issues as excuses to not pay. Check your terms, but in many cases as long as you have delivered the goods or services, they have to pay. This doesn’t mean there won’t have to be a query resolution process (where the buyer may be due compensation), but they can’t delay payment of the invoice. For further guidance on dealing with invoice disputes, see our guide to collections for credit controllers.

Your customer may tell you they can’t pay you until they’ve been paid. Their cash flow issues aren’t yours. Be firm but fair in your response. Inform them this is not acceptable and get a promised payment date. If they continue with this behaviour, reconsider selling on payment terms or keeping them as a customer at all.

Some customers will cite issues as excuses to not pay. Check your terms, but in many cases as long as you have delivered the goods or services, they have to pay. This doesn’t mean there won’t have to be a query resolution process (where the buyer may be due compensation), but they can’t delay payment of the invoice. For further guidance on dealing with invoice disputes, see our guide to collections for credit controllers .

Your customer may tell you they can’t pay you until they’ve been paid. Their cash flow issues aren’t yours. Be firm but fair in your response. Inform them this is not acceptable and get a promised payment date. If they continue with this behaviour, reconsider selling on payment terms or keeping them as a customer at all.

Accounts receivable (AR) is the practice of ensuring a business’ customers pay for goods or services in a reasonable time. Applies to businesses that sell on payment terms. Two terms often used interchangeably are credit control (more common in the UK) and debtor management (more common in Australia).

Part of the conditions of a sale. Specifies when and how the buyer must pay the seller the amount due. Commonly used to refer to the time period that payment is due, after the invoice is issued. 14 days, 30 days, and 60 days are typical examples.

A representation of the money going in and out of a business. Typically calculated over a month period, although because of this is subject to sea- sonal fluctuations. Without a positive cash flow, a business may be unable to pay its debts or invest in growth.

Net sales generated by a business, without de- ducting any expenses. Represents the magnitude of business a company conducts.

The process of matching your business’ accounting records to the relevant bank statements. Used to determine the differences between them, and act accordingly off these results to ensure they match. Critical that it is done on a regular basis - at least monthly, but best empowers accounts receivable if done weekly. Some businesses may benefit from daily reconciliation.

The numbers of days’ worth of turnover that a business is owed by customers, but has yet to receive. Calculated at any instant in time by dividing current debtors by turnover for the last year, multi- plied by 365 (days in the year). Although other time periods than year can be used, this is typical.

Similar to debtor days but accounts for the due dates of the invoices. This is because debtor days of 30, for example, could be good for a business that sells on 90 day payment terms but bad for a business that sells on 14 day terms. At the invoice level, DvD is a count of the number of days between invoice due date and payment date. At a customer level, DvD is an average of the invoice DvDs over a given time period.

The average number of days that receivables remain outstanding before they’re collected. Typically calculated for all outstanding invoices at any point in time. Represents the effectiveness of a company’s credit control.

Email reminders sent to customers to chase up unpaid invoices. The backbone of credit control, alongside phone calls. This often manual, time-consuming process can be automated with accounts receivable software.

A log of all communications had between the seller and the buyer with respect to the payment of an invoice. Should capture dates, times, parties involved, contact details, communication medium, communication content, and invoice reference number. Used to empower accounts receivable and to rely upon as evidence if an unpaid invoice is escalated to legal action. Also referred to as an audit trail.

Also referred to as debtor management systems or credit control software, accounts receivable software is a class of software designed to minimise the human resource required by businesses to administer credit control or accounts receivable, as well as reduce potential for human error. Typically automates the sending of chasers and automatically maintains audit trails of all invoice communications in one centralised location. Also, provide insights to help businesses decide which customers to grant credit to and how best to chase up customers to pay their invoices.

Download the fact sheet on accounts receivable automation for a concise view outlining the key features, benefits, and advantages of implementing an automated system for managing accounts receivable.